FiNMAX User Reviews & Opinions App & Demo Info

I read an article on as regards to a recovery expert and genius so I reached out to SCAM RECOVERY SITE, and to my surprise I got all bitcoins recovered within 24hours frame. FiNMAX is an online broker that provides CFDs, forex, and binary options. While binary options are outlawed in most countries today, this broker avoids those regulations by operating out of Seychelles. Their parent company, Max Capital Limited, has its headquarters there.

I must admit that Finmax trully is the only broker, where is possible to earn and cashout money. Trader can easely make money from home – very important ability for current times. Corona take away all trash and rubbish leaving Finmax and a couple of other trully honest brokers. Hope that i wont loose all my money) Im a little bit risky guy.

Frank (Francie) Mullen, Carra, Bonniconlon, Ballina – Midwest Radio

Frank (Francie) Mullen, Carra, Bonniconlon, Ballina.

Posted: Sat, 21 Jan 2023 08:00:00 GMT [source]

So, imho, every trader should try this place to trade. There is no any obstacle whan you withdraw your funds. So after Tesla big deal with respect to bitcoin purchase im really convinced that its really profitable to trade here for price increase in a long and middle terms. You simply loosing your time and opportunity to earn nowadays. Never thought i ever see truly honest broker where its possible to trade in plus.

Trading Platform

Morris Processing Ltd holds the IFMRRC Certificate of Compliance Number TSRF RU 0395 AA Vv0103. Help future customers by talking about customer service, price, delivery, returns & refunds. All information on 55brokers.com is only published for general information purposes. We do not present any investment advice or guarantees for the accuracy and reliability of the information. Read about FBS Broker which offers a Demo account.

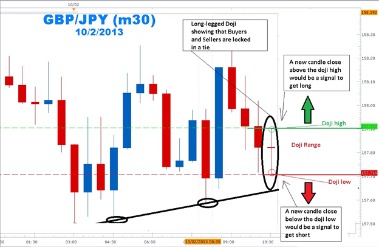

Couple of a days ago heard about Binary Options for a first time in my life. Im here to admit that its really easy and fast – to withdraw your incomes from finmax cashier. But a realize that was completely my fault, this broker never steel money from traders. In binary options you have simple rules, i feel comfortable when i trade on them. On CFD platform trading is normal, the list of trading instruments is very wide, the risks are acceptable. The broker has its own platform that was developed by a team made of experienced traders and IT experts.

In addition, you will gain access to free financial market news published on the platform. Please be noted that all information provided by ThatSucks.com are based on our experience and do not mean to offend or accuse any broker with illegal matters. The words Suck, Scam, etc are based on the fact that these articles are written in a satirical and exaggerated form and therefore sometimes disconnected from reality. All information should be revised closely by readers and to be judged privately by each person. I get more and more confident and will open a live account after a couple of weeks doing demo. The required turnover before the bonus and profits can be withdrawn is fair and in line with the industry standards but the exact volume changes according to the type of account you have.

Moving Account

One of the most superior platforms in the binary options world. Deeply impressed with Finmax from the first glimpse. More interested when using its trading platforms. Quite sure that Finmax’s trading environment stays at the top of the binary options industry. The broker doesn’t just offer a trading platform – it also teaches its clients by providing helpful education materials, strategies, and news. There is a whole section dedicated for education.

From start i vebeen cashouting every month not less than 1000 bukses. I started to trade on this broker couple of months ago. I suppose that it is one of the best sites in Europe. At the end of spring i decided to put some money on finmax (500$). My personaltrading system gives me about 1000$ per month, Not a huge number but this is a question of stability. Just made the third withdrawal from this broker and got money after 24 hours.

However, we didn’t find this company in the register of the Bulgarian Financial Supervision Commission. I ve been trading on finmax since its start in 2015. This broker never dissapointed me, giving great chances to trade and to earn.

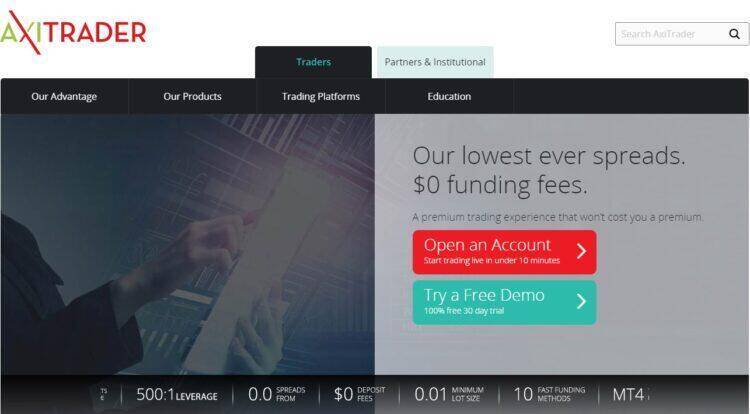

FiNMAX Review

Finmax FX has a rich education center where traders can learn to trade from basic to advanced. Besides, the company also offers an “Analytics” center with financial news, market insights, and new investment strategies updated minute by minute. If you are unwilling to trade with real money right away, you can start with a demo account. This is a free account with $1,000 virtual money, allowing you to practice trading without risks. FinmaxFX is an FX and CFD broker that is registered and regulated by the reputable iFMRRC and VFSC. Although a fairly new broker it has positive personal reviews and offers a fair deal that will suit the needs of most traders.

FinmaxFX does not only provide sufficient research tools but also provides a number of educational resources. This is in the form of e-books, video lessons, webinars, and a forex glossary and can be found under the Education link. Forex trading, or currency or FX trading, involves the currency exchange market where individuals, companies, and financial institutions exchange currencies for one another at floating rates.

Min Deposit

My conclusions are not baseless ’cause I regularly withdraw money from my account. I regret trusting this company FINMAX / MAX CAPITAL. Looks like they are a scam/fraud company. I am trying to reach them from 2 weeks but no response or resolution from them.

We may receive compensation from the companies we write about. Always verify that your broker, is licensed by your local financial regulator. The unique aspect of Finmax, is the trading software that they offer traders and clients. It was developed by the Trade Smarter company, and it was customized exclusively for them.

Bonuses and Promotions

The minimum deposit and minimum investment per trade encourage amateurs to start their trading career. FiNMAX, owned and operated by operated by Morris Processing Ltd., is a Binary Options provider that offers high quality and spectacular trading services. Regarding secure and client oriented financial market services, they won several awards such as “Trusted Broker of 2015”. Some brokers like to boast payouts that seem too good to be true, which is often an indication that they are just that. This particular broker offers returns of 70-80%, which are realistic, but there are higher payouts available for platinum or VIP account holders. When choosing a broker, be careful not to be drawn into those that are offering more than 90%.

The agent responded quickly and https://traderoom.info/d all the necessary information without being pushy. Trading foreign exchange on margin carries a high level of risk and can result in losses and may not be suitable for everybody. Persons below 18 years of age are not eligible to open an account with FinmaxFX. It also provides an economic calendar that is professional and easy to use, as well as calculators and a currency converter.

Is one of the leading manufacturer of Floating Fish Feed etc. We finmax review these to our customers at market leading rates. Free to get started, easy to add your whole sales team, commit to monthly or annual plans. Based on the CNMV warning, the Danish FSA reported FinMax as a scam broker operating with the EU/EEA zone. Spanish CNMV issued a warning against FinMax broker, warning its citizens not to accept any offers from this broker. When it comes to education, Finmax can still do some improvements.

There were no problems with withdrawing funds from my Standard Account. The withdrawal of money is usually according to the regulations, there was a hitch once, but as it turned out, it was because of my bank. Despite the bans and warnings, binary options brokers continue to reel in new clients. We’re here to help traders whose broker has locked their funds behind obscure bonus conditions. Call us today to hear more about what a chargeback can do for you.

- The website does not provide investment services or personal recommendations to clients to trade any financial instrument.

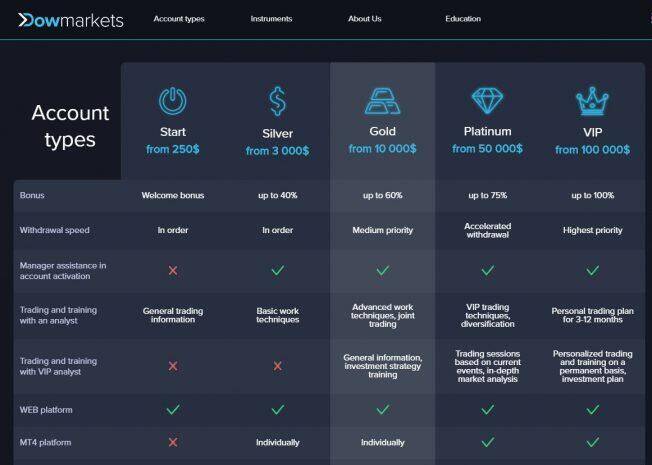

- Opening a Gold account requires a minimum deposit of $5000, and A Platinum VIP account may be opened with a negotiable, larger minimum deposit.

- So, imho, every trader should try this place to trade.

It strives to provide customers with modern training methods, as well as updating and timely information regarding the main events taking place in the financial markets. Finmax offers all its new clients a risk-free trade as their first trade. Up to $1,000 may be risked on this trade, but the maximum amount is also governed by the proportion of the total amount deposited in the account. Silver account holders and up receive dedicated account managers. Gold and Platinum account holders receive unlimited free signals, while Platinum account holders also get a free withdrawal service.