Helen Of Troy HELE Stock Price Live Quote Historical Chart

Contents:

There may be delays, omissions, or inaccuracies in the Information. The technique has proven to be very useful for finding positive surprises. In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks produced a positive surprise 70% of the time, while they also saw 28.3% annual returns on average, according to our 10 year backtest.

What is the PE ratio of Helen of Troy?

Helen Of Troy PE ratio as of February 13, 2023 is 12.22.

Past performance is not a guarantee of future results, and a loss of original capital may occur. None of the information presented should be construed as an offer to sell or buy any particular security. The Company offers products and solutions for its customers through a diversified portfolio of brands. The Company’s segments include Home & Outdoor, Health & Wellness and Beauty. The Home & Outdoor segment provides a range of products to help with food preparation, cooking, cleaning, organization, beverage service, and other tasks to ease everyday living for families.

Guru Trades

Helen Of Troy’s market cap is calculated by multiplying HELE’s current stock price of $97.78 by HELE’s total outstanding shares of 23,992,278. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. These are possible Helen Of Troy Limited weekly share price targets. The stock can touch or cross these levels during weekly trading sessions. The Barchart Technical Opinion widget shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals.

Access unmatched financial data, news and content in a highly-customised workflow experience on desktop, web and mobile. Helen of Troy has been battling escalated cost concerns and softness in its Beauty segment. Management lowered its fiscal 2023 guidance on the last earnings call. The Parks for All giving program reaches a lifetime contribution of over $3 million in pursuit to build happier, healthier, and more equitable outdoor futures for all BEND, Ore. , Jan. 19, 2023 /PRNew…

Helen Of Troy Stock Predictions

An affiliate of Public may be “testing the waters” and considering making an offering of securities under Tier 2 of Regulation A. No money or other consideration is being solicited and, if sent in response, will not be accepted. No offer to buy securities can be accepted, and no part of the purchase price can be received, until an offering statement filed with the SEC has been qualified by the SEC. An indication of interest to purchase securities involves no obligation or commitment of any kind. I understand that I am receiving a special one-time deal and will be billed $397 for 6 months membership and that after 6 months I will be billed at $397 quarterly thereafter unless I choose to cancel, which I may do at any time. I have read and understand the terms and disclaimers related to the program. All investments involve risks, including the loss of principal.

As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. https://day-trading.info/ It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. The Barchart Technical Opinion rating is a 56% Sell with a Weakening short term outlook on maintaining the current direction. Live educational sessions using site features to explore today’s markets.

Our research is based on sources that we believe to be reliable. However, we do not make any representation or warranty, expressed or implied, as to the accuracy of our research, the completeness, or correctness or make any guarantee or other promise as to any results that may be obtained from using our research. Some discussions contain forward looking statements which are based on current expectations and differences can be expected. All of our research, including the estimates, opinions and information contained therein, reflects our judgment as of the publication or other dissemination date of the research and is subject to change without notice. Further, we expressly disclaim any responsibility to update such research.

Analyst Estimate

The Helen Of Troy 52-week low stock price is 82.94, which is 15.2% below the current share price. The Helen Of Troy 52-week high stock price is 221.71, which is 126.7% above the current share price. Brokerage services for alternative assets available on Public are offered by Dalmore Group, LLC (“Dalmore”), member of FINRA & SIPC.

Brokerage services for US-listed, registered securities are offered to self-directed customers by Open to the Public Investing, Inc. (“Open to the Public Investing”), a registered broker-dealer and member of FINRA & SIPC. Additional information about your broker can be found by clicking here. Open to Public Investing is a wholly-owned subsidiary of Public Holdings, Inc. (“Public Holdings”). This is not an offer, solicitation of an offer, or advice to buy or sell securities or open a brokerage account in any jurisdiction where Open to the Public Investing is not registered. Securities products offered by Open to the Public Investing are not FDIC insured. Apex Clearing Corporation, our clearing firm, has additional insurance coverage in excess of the regular SIPC limits.

Which exchange is Helen listed on?

HELE:USNASDAQ GS.

Discuss news and analysts’ price predictions with the investor community. We are working on updating this web app to fully enable Quantitative Ratios. All other hot penny stocks today’s best cheap stocks current web features including annual reports, price sensitive announcements, dividends and earnings transcripts are free to use here on our web app.

Trading Services

To calculate, start with total shares outstanding and subtract the number of restricted shares. Restricted stock typically is that issued to company insiders with limits on when it may be traded.Dividend YieldA company’s dividend expressed as a percentage of its current stock price. Helen Of Troy Limited is a global consumer products company that offers a range of solutions for its customers through a range of brands. The Company is a global designer, developer, importer, marketer and distributor of a portfolio of brand-name consumer products. The Housewares segment provides a range of consumer products for the home.

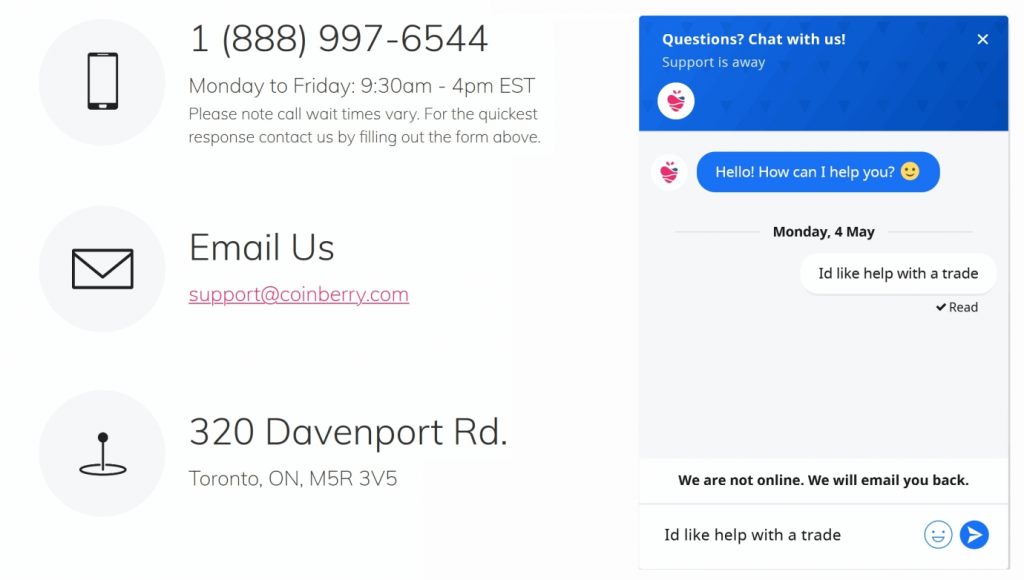

After submitting your request, you will receive an activation email to the requested email address. You must click the activation link in order to complete your subscription. Sign Up NowGet this delivered to your inbox, and more info about our products and services.

If you had invested in Helen Of Troy stock at $16.13, your return over the last 25 years would have been 506.2%, for an annualized return of 7.47% . Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services.

Financials Helen of Troy Ltd.(HELE)

None of these entities provide legal, tax, or accounting advice. You should consult your legal, tax, or financial advisors before making any financial decisions. This material is not intended as a recommendation, offer, or solicitation to purchase or sell securities, open a brokerage account, or engage in any investment strategy.

What brands does Helen of Troy own?

It is the parent corporation of OXO International Ltd., Kaz, Inc., Steel Technologies, LLC, and Idelle Labs, Ltd, among others. The company is headquartered in Hamilton, Bermuda, with U.S. operations headquartered in El Paso, Texas. The company is named after the historical or mythic figure Helen of Troy.

“Alternative assets,” as the term is used at Public, are equity securities that have been issued pursuant to Regulation A of the Securities Act of (“Regulation A”). These investments are speculative, involve substantial risks , and are not FDIC or SIPC insured. Alternative Assets purchased on the Public platform are not held in an Open to the Public Investing brokerage account and are self-custodied by the purchaser.

The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. Why Helen of Troy Limited Stock Popped Today Steve Symington | Jul 9, 2018 The consumer brands specialist started its new fiscal year on a high note. Rich Duprey | Feb 6, 2014 Beauty may be in the eye of the beholder, but this personal care stock can still turn heads.

Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods. Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating. After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study. For example, a price above its moving average is generally considered an upward trend or a buy. The stock of Helen Of Troy Limited can try to reach, or even cross these levels in monthly sessions.

The Company is a global designer, developer, importer and distributor of an expanding portfolio of brand-name consumer products. Shares Sold ShortThe total number of shares of a security that have been sold short and not yet repurchased.Change from LastPercentage change in short interest from the previous report to the most recent report. Exchanges report short interest twice a month.Percent of FloatTotal short positions relative to the number of shares available to trade. Over the next 52 weeks, Helen Of Troy has on average historically risen by 22.1% based on the past 42 years of stock performance. Sign up for a Robinhood brokerage account to buy or sell Helen of Troy stock and options commission-free. Robinhood gives you the tools you need to put your money in motion.

- Live educational sessions using site features to explore today’s markets.

- The Health & Home segment focuses on healthcare devices, such as thermometers, humidifiers, blood pressure monitors and heating pads; water filtration systems, and small home appliances, such as portable heaters, fans, air purifiers, and insect control devices.

- After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study.

- No offer to buy securities can be accepted, and no part of the purchase price can be received, until an offering statement filed with the SEC has been qualified by the SEC.

Provides a general description of the business conducted by this company. Investing in certain stocks can pay off in the long run, especially if you hold on for a decade or more. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. To opt-in for investor email alerts, please enter your email address in the field below and select at least one alert option.

Is Helen of Troy a good stock to buy?

On average, Wall Street analysts predict that Helen Of Troy's share price could reach $134.00 by Jan 6, 2024. The average Helen Of Troy stock price prediction forecasts a potential upside of 28.69% from the current HELE share price of $104.13.